Your Irs letter from kansas city 2021 images are available in this site. Irs letter from kansas city 2021 are a topic that is being searched for and liked by netizens today. You can Find and Download the Irs letter from kansas city 2021 files here. Get all free photos.

If you’re looking for irs letter from kansas city 2021 pictures information connected with to the irs letter from kansas city 2021 keyword, you have come to the right blog. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and locate more informative video content and images that match your interests.

Irs Letter From Kansas City 2021. After that time has passed call the IRS by phone see contact info below and ask them to mail or fax you an EIN Verification Letter 147C. IRS has processed 168 million in the 2021 filing season as of early December and issued 1298 million refunds. On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. Aggregate amount of advance CTC payments received in 2021 This information will be used on IRS schedule.

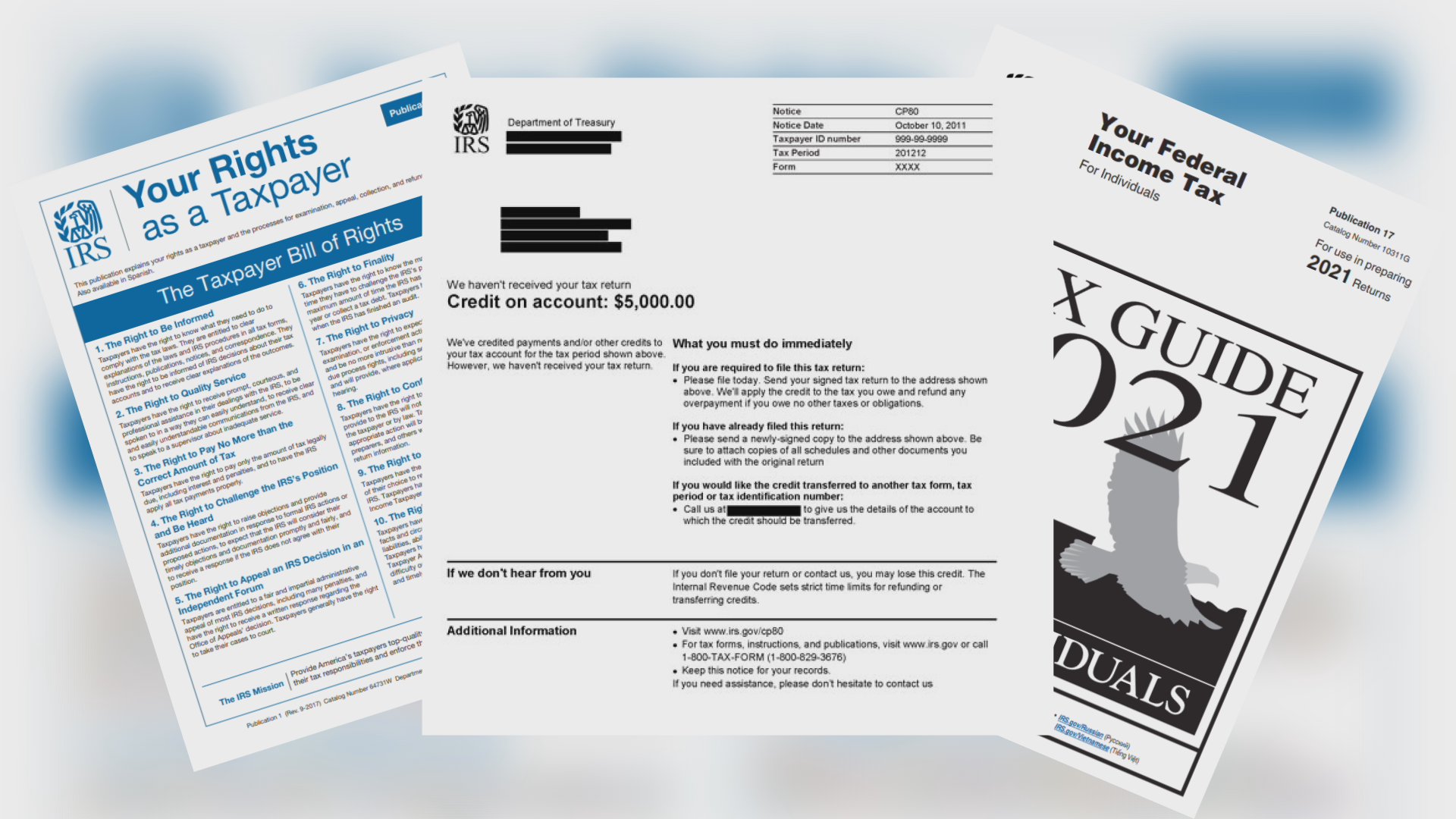

Stimulus Checks Letter From Irs Explains Recovery Rebate From fox59.com

Stimulus Checks Letter From Irs Explains Recovery Rebate From fox59.com

This includes individuals with low or no earnings who normally dont file taxes. The 81400-square-foot 126 million project one of the first announced in a Kansas City-area Opportunity Zone will have 64 residential units across. In many cases as outlined below bankruptcy might end IRS harassment for good. Each document is labeled with Letter 6419 and 2021 Total Advance Child. Most IRS collections start with a notice of past-due taxes. The totality of the.

Most IRS collections start with a notice of past-due taxes.

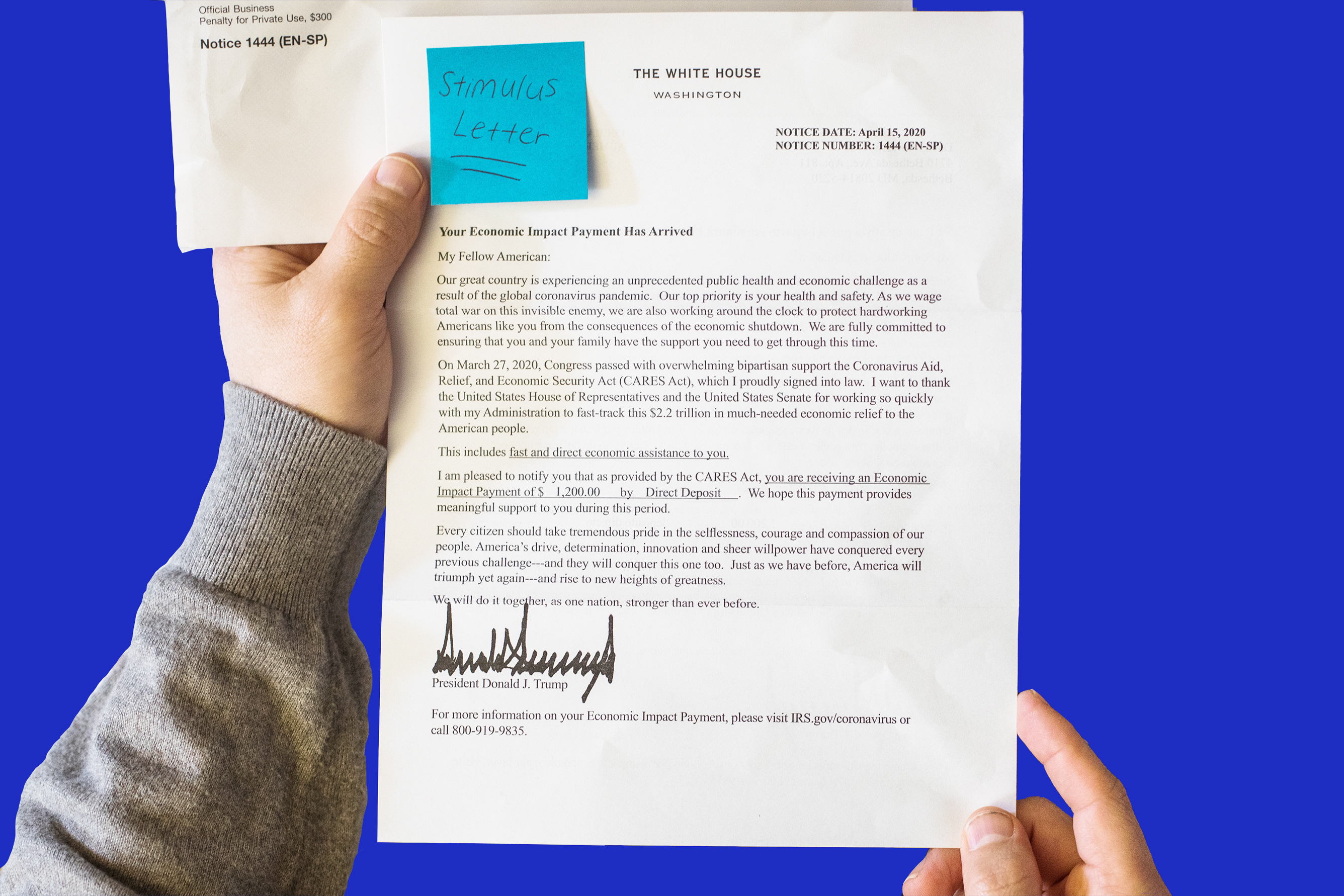

Getting personal help from IRS. Earlier in the program the IRS sent out a Notice 1444-C that shows the third Economic Impact Payment advanced for tax year 2021. The IRS is so big that they have their own zip code. The actual IRS tax return mailing address including UPS and FedEx options will be based on the state or territory you currently live or reside in and on the type of Form 1040 that you are filing. Then every few months the IRS sends another letter. 24 with more than 8 million original and amended individual returns unprocessed another roughly 15 million unprocessed original and amended business returns and close to 5 million other letters and documents from taxpayers in response to IRS notices.

Source: pinterest.com

Source: pinterest.com

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. The totality of the. In many cases as outlined below bankruptcy might end IRS harassment for good. Additionally the address is different based on whether you. If when you search for your notice or letter using the Search on this page it doesnt return a result or you believe the notice or letter looks suspicious contact us at 800-829-1040.

The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. The IRS said it started sending the letters to families in late December. Child Tax Credit payments should receive IRS letter. Each document is labeled with Letter 6419 and 2021 Total Advance Child. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit.

Source: in.pinterest.com

Source: in.pinterest.com

Earlier in the program the IRS sent out a Notice 1444-C that shows the third Economic Impact Payment advanced for tax year 2021. Even if you have no income you are still eligible but need to file taxes to receive your stimulus payment. After that time has passed call the IRS by phone see contact info below and ask them to mail or fax you an EIN Verification Letter 147C. IRS has processed 168 million in the 2021 filing season as of early December and issued 1298 million refunds. 1 day agoThe IRS entered the start of tax filing season this year which began Jan.

Source: gt.usembassy.gov

Source: gt.usembassy.gov

Most IRS collections start with a notice of past-due taxes. The actual IRS tax return mailing address including UPS and FedEx options will be based on the state or territory you currently live or reside in and on the type of Form 1040 that you are filing. It is important to keep this IRS letter as you will need it when you start preparing your 2021 federal return. Child Tax Credit payments should receive IRS letter. Entity Department Internal Revenue Service Kansas City MO 64999.

Source: kbtx.com

Source: kbtx.com

Each document is labeled with Letter 6419 and 2021 Total Advance Child. It is important to keep this IRS letter as you will need it when you start preparing your 2021 federal return. However the IRS tool only saw one negative factor in isolation and denied the abatement. The IRS is so big that they have their own zip code. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit.

Source: fox4kc.com

Source: fox4kc.com

Child Tax Credit payments should receive IRS letter. 24 with more than 8 million original and amended individual returns unprocessed another roughly 15 million unprocessed original and amended business returns and close to 5 million other letters and documents from taxpayers in response to IRS notices. On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. Entity Department Internal Revenue Service Ogden UT 84201. Fortunately filing Chapter 7 bankruptcy is a straightforward way to stop IRS harassment.

Source: marca.com

Source: marca.com

Additionally the address is different based on whether you. On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. Child Tax Credit payments should receive IRS letter. Most IRS collections start with a notice of past-due taxes. My wife and I received a letter from the IRS Office Austin TX– dated June 14 2021 regarding a past due amount for 30882.

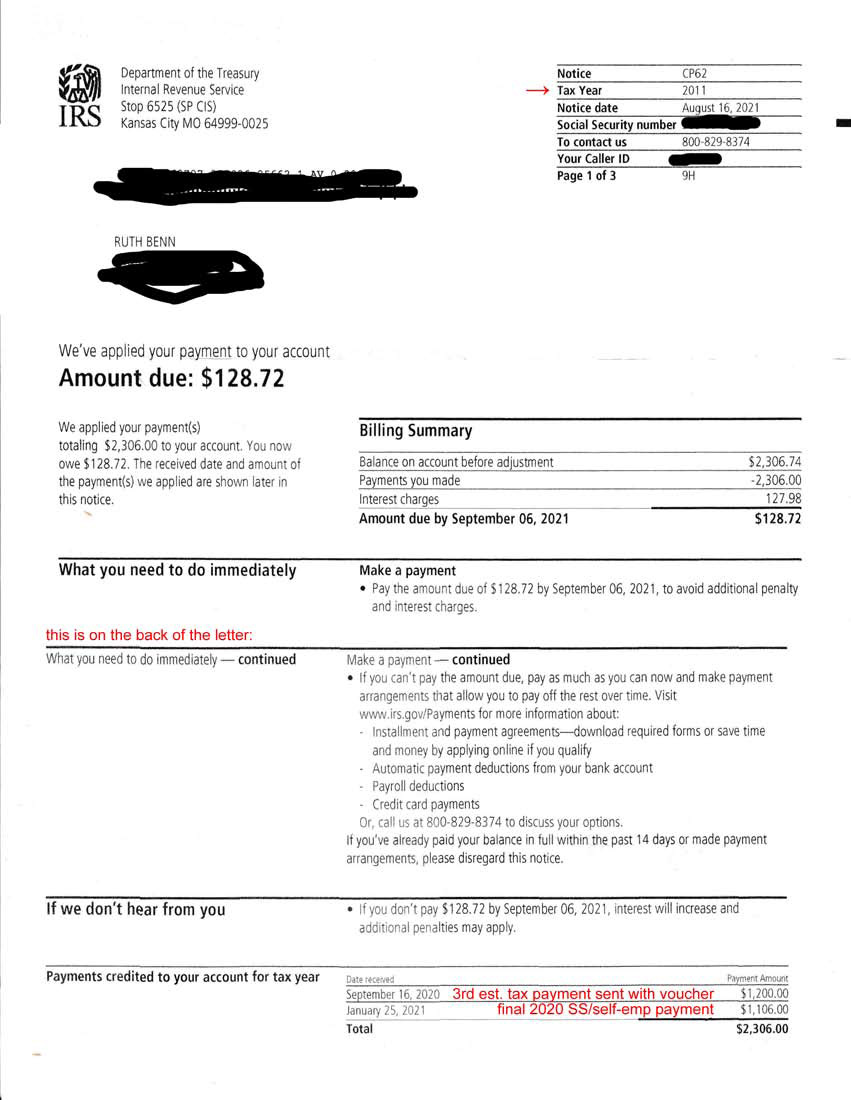

Source: nwtrcc.org

Source: nwtrcc.org

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. I f you are one of the 36 million American families who got advance child tax credit payments the IRS is about to send you an information letter. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. If you determine the notice or letter is fraudulent please follow the IRS assistors guidance or visit our Report Phishing page for next steps. Each document is labeled with Letter 6419 and 2021 Total Advance Child.

Source: accountingtoday.com

Source: accountingtoday.com

Most IRS collections start with a notice of past-due taxes. Then every few months the IRS sends another letter. Under this proposal banks would be required to submit annual reports to the IRS on. Each document is labeled with Letter 6419 and 2021 Total Advance Child. Fortunately filing Chapter 7 bankruptcy is a straightforward way to stop IRS harassment.

Source: nytimes.com

Source: nytimes.com

If you saved that letter last year you can refer to it as well. If you determine the notice or letter is fraudulent please follow the IRS assistors guidance or visit our Report Phishing page for next steps. IRS deadline back in April despite pandemic. Each document is labeled with Letter 6419 and 2021 Total Advance Child. People receiving these letters.

Source: pinterest.com

Source: pinterest.com

Kansas City MO 64999 855-821-0094 Alaska Arizona California Colorado. Fortunately filing Chapter 7 bankruptcy is a straightforward way to stop IRS harassment. Letter 6475 only applies to the third round of Economic Impact Payments that were. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. Most IRS collections start with a notice of past-due taxes.

![]() Source: reddit.com

Source: reddit.com

As soon as you get it. Under this proposal banks would be required to submit annual reports to the IRS on. I f you are one of the 36 million American families who got advance child tax credit payments the IRS is about to send you an information letter. The IRS also started issuing monthly payments to families with children in July 2021 as an advance for the increased child tax credit. Bankruptcy and the Automatic Stay.

Source: pinterest.com

Source: pinterest.com

There is no street address needed. You could receive up to 1200 for yourself 2400 for a married couple and. Under this proposal banks would be required to submit annual reports to the IRS on. Those who received a third stimulus check in 2021 should soon be getting a letter in the mail from the Internal Revenue Service for tax. Community Builders of Kansas City will develop The Rochester on Blue Parkway the first market-rate multifamily development east of Prospect Avenue in Kansas City Missouri in generations.

Source: money.com

Source: money.com

This includes individuals with low or no earnings who normally dont file taxes. If you saved that letter last year you can refer to it as well. Which we paid by check Pioneer Bank Roswell NM 1155 before. After that time has passed call the IRS by phone see contact info below and ask them to mail or fax you an EIN Verification Letter 147C. Community Builders of Kansas City will develop The Rochester on Blue Parkway the first market-rate multifamily development east of Prospect Avenue in Kansas City Missouri in generations.

Source: in.pinterest.com

Source: in.pinterest.com

November 2021 Department of the Treasury Internal Revenue Service Short Form Request for Individual Tax Return Transcript Request may not be processed if the form is incomplete or illegible. Aggregate amount of advance CTC payments received in 2021 This information will be used on IRS schedule. 1 day agoThe IRS entered the start of tax filing season this year which began Jan. Letter 6475 only applies to the third round of Economic Impact Payments that were. Bankruptcy and the Automatic Stay.

Source: fox59.com

Source: fox59.com

On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. Getting personal help from IRS. After that time has passed call the IRS by phone see contact info below and ask them to mail or fax you an EIN Verification Letter 147C. Community Builders of Kansas City will develop The Rochester on Blue Parkway the first market-rate multifamily development east of Prospect Avenue in Kansas City Missouri in generations.

![]() Source: pinterest.com

Source: pinterest.com

After that time has passed call the IRS by phone see contact info below and ask them to mail or fax you an EIN Verification Letter 147C. On average it takes about 30 days to receive an LLC address change confirmation letter from the IRS but please allow 45 to 60 days. IRS deadline back in April despite pandemic. Letter 6475 only applies to the third round of Economic Impact Payments that were. WJW Those who received a third stimulus check in 2021 should soon be getting a letter in the mail from the Internal Revenue Service for tax-filing purposes.

Source: marca.com

Source: marca.com

IRS has processed 168 million in the 2021 filing season as of early December and issued 1298 million refunds. Additionally the address is different based on whether you. If the taxpayer was incapacitated at the time of filing or there was emotional distress and the taxpayer had limited financial knowledge and this was the first time they filed late an abatement is possible. Two Missouri schools land on list of best colleges in America. I f you are one of the 36 million American families who got advance child tax credit payments the IRS is about to send you an information letter.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title irs letter from kansas city 2021 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.