Your Hmrc late filing penalty appeal letter template images are ready in this website. Hmrc late filing penalty appeal letter template are a topic that is being searched for and liked by netizens today. You can Download the Hmrc late filing penalty appeal letter template files here. Find and Download all royalty-free vectors.

If you’re looking for hmrc late filing penalty appeal letter template images information related to the hmrc late filing penalty appeal letter template keyword, you have pay a visit to the right blog. Our site frequently gives you hints for seeing the highest quality video and image content, please kindly surf and find more informative video articles and images that fit your interests.

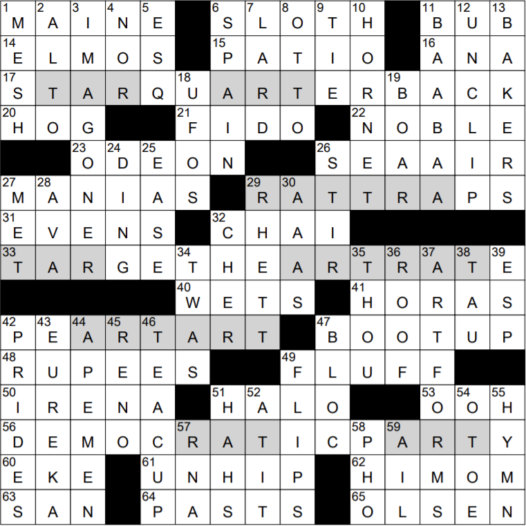

Hmrc Late Filing Penalty Appeal Letter Template. How to appeal a penalty. Late 1 day late 100 penalty. If HMRC sends you a penalty letter by post. Late appeal of this sample appeal letter that penalty cases include a particular decision.

Late Filing Penalties Appeals Pdf Free Download From docplayer.net

Late Filing Penalties Appeals Pdf Free Download From docplayer.net

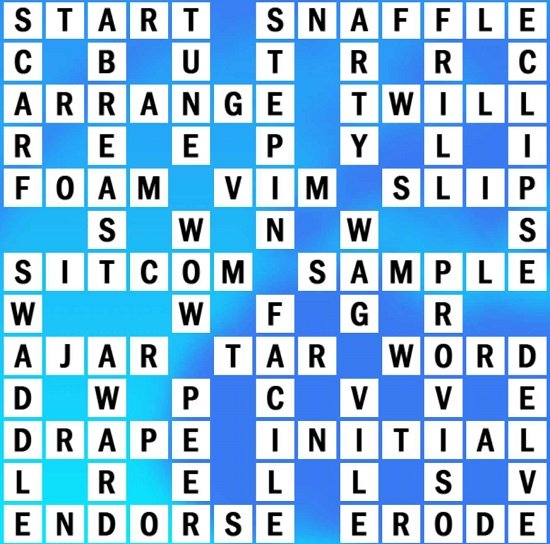

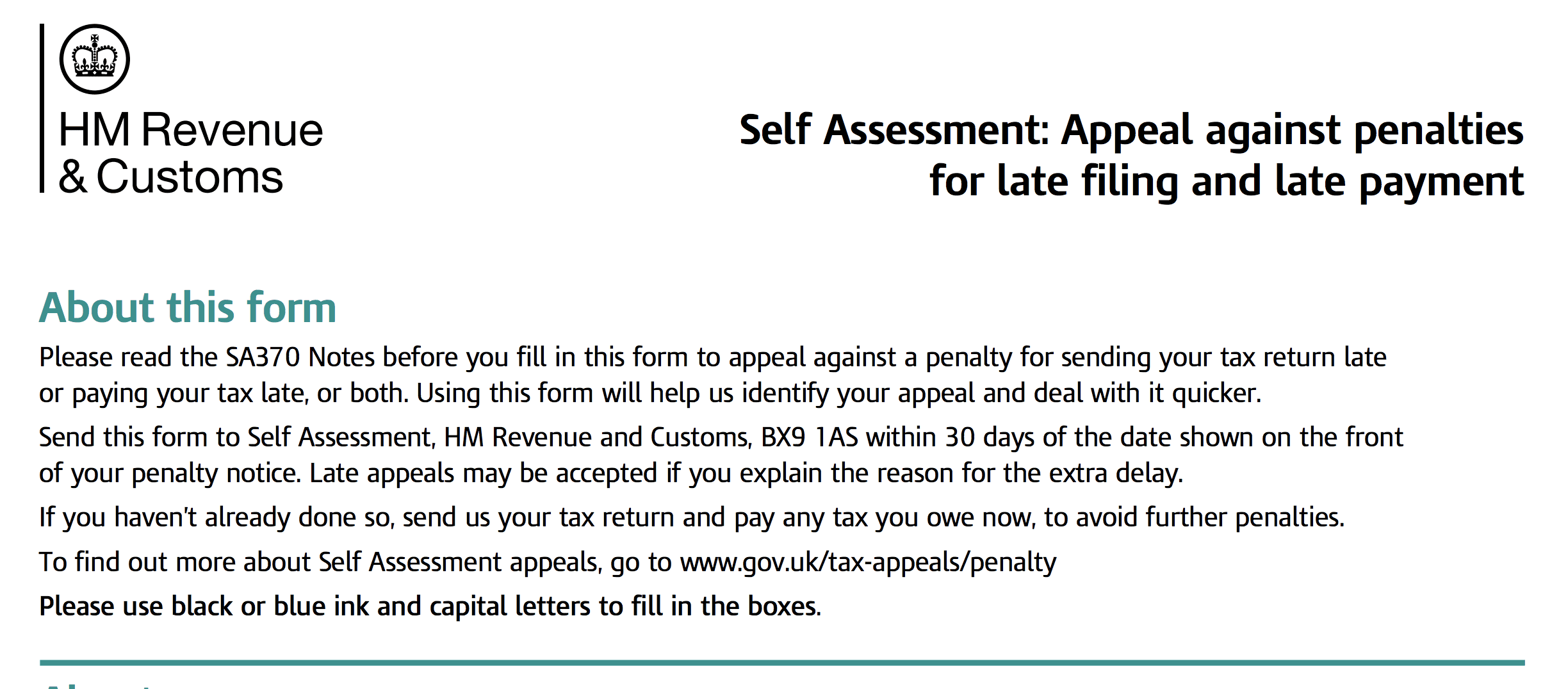

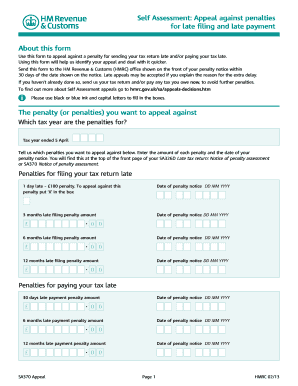

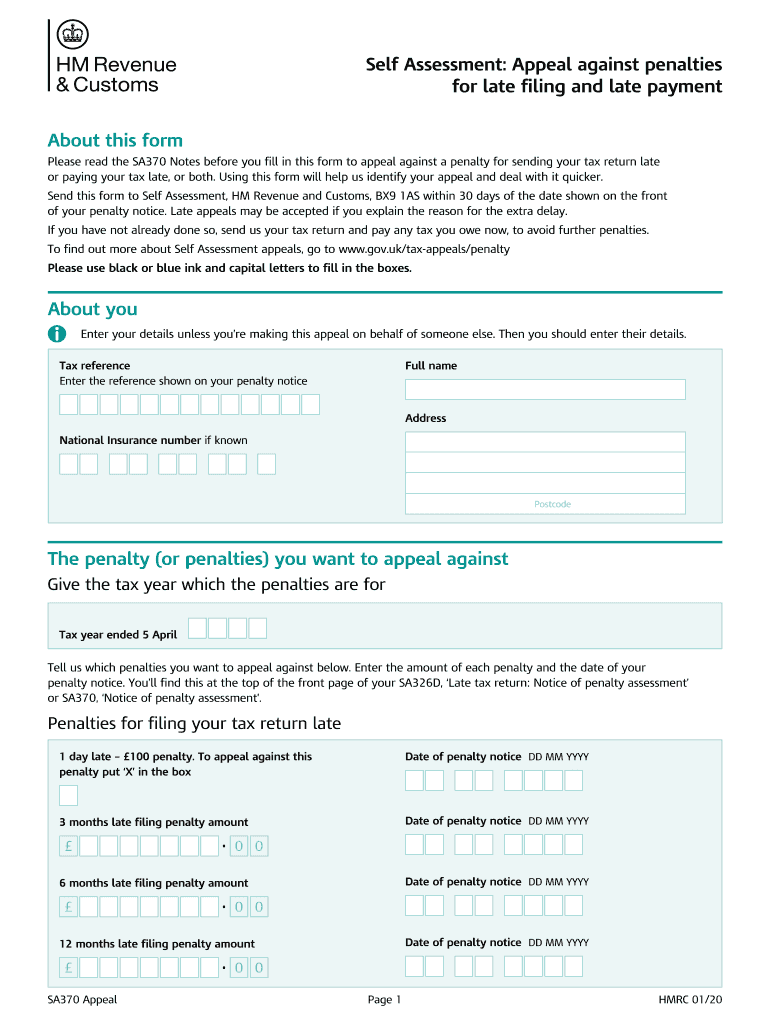

Print the postal form SA370 fill it in and post to HMRC to appeal against a penalty. Therefore fees will only be waived in exceptional circumstances. Print and send the SA370 form via post. If you have an earlier penalty or prefer to use a postal form you can download form SA370 and send the completed form to HMRC. How to appeal an HMRC decision What type of decision can you appeal. HMRC believes that you needed to file a tax return but you didnt.

Why you received a fine.

Print the postal form SA370 fill it in and post to HMRC to appeal against a penalty. If HMRC sends you a penalty letter by post. You have successfully completed this document. This document is locked as it has been sent for signing. The sender is writing to request waiving the penalty interest regarding his her late payment for various reasons. Using this form will help us identify your appeal and deal with it quicker.

Source: goselfemployed.co

Source: goselfemployed.co

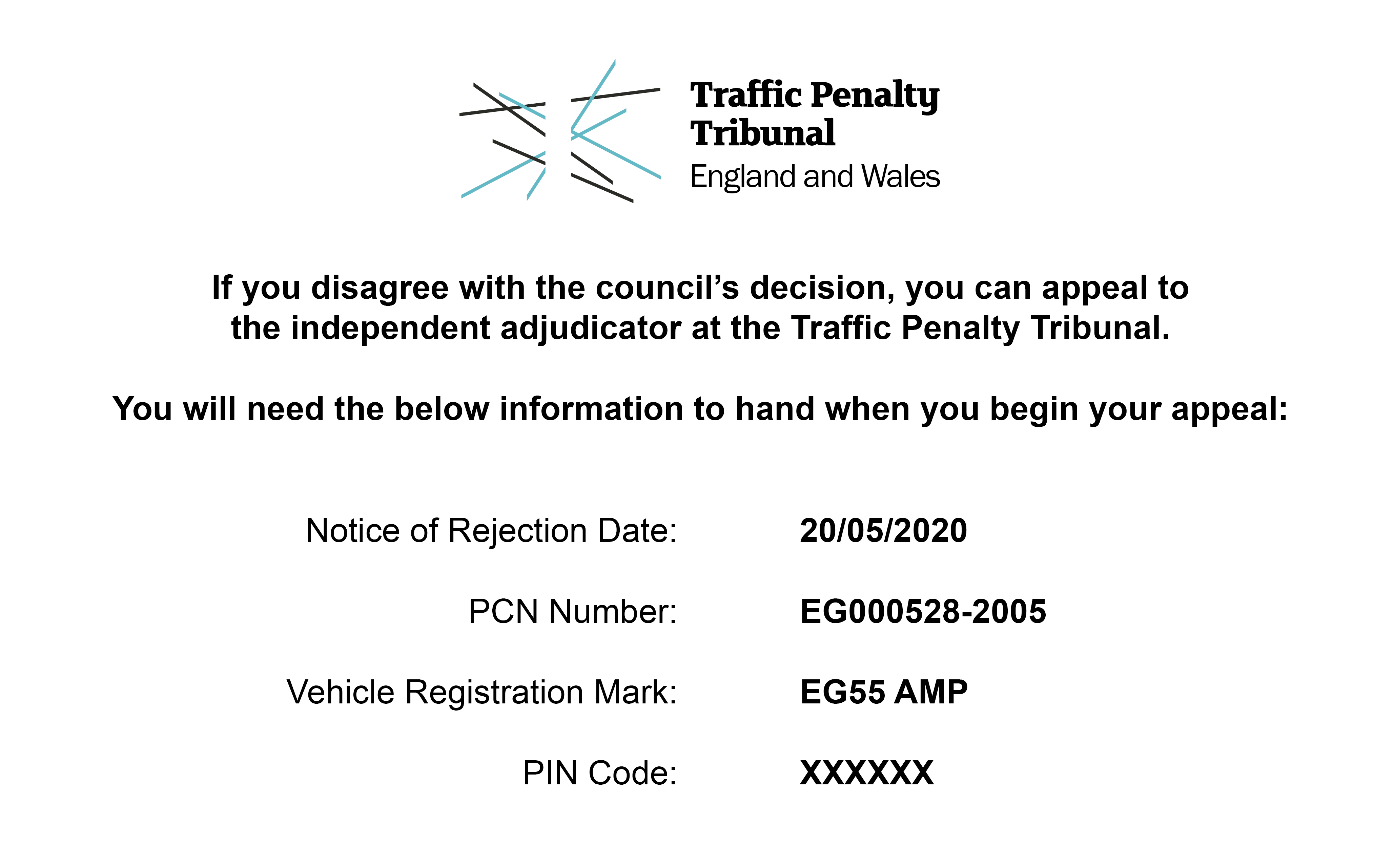

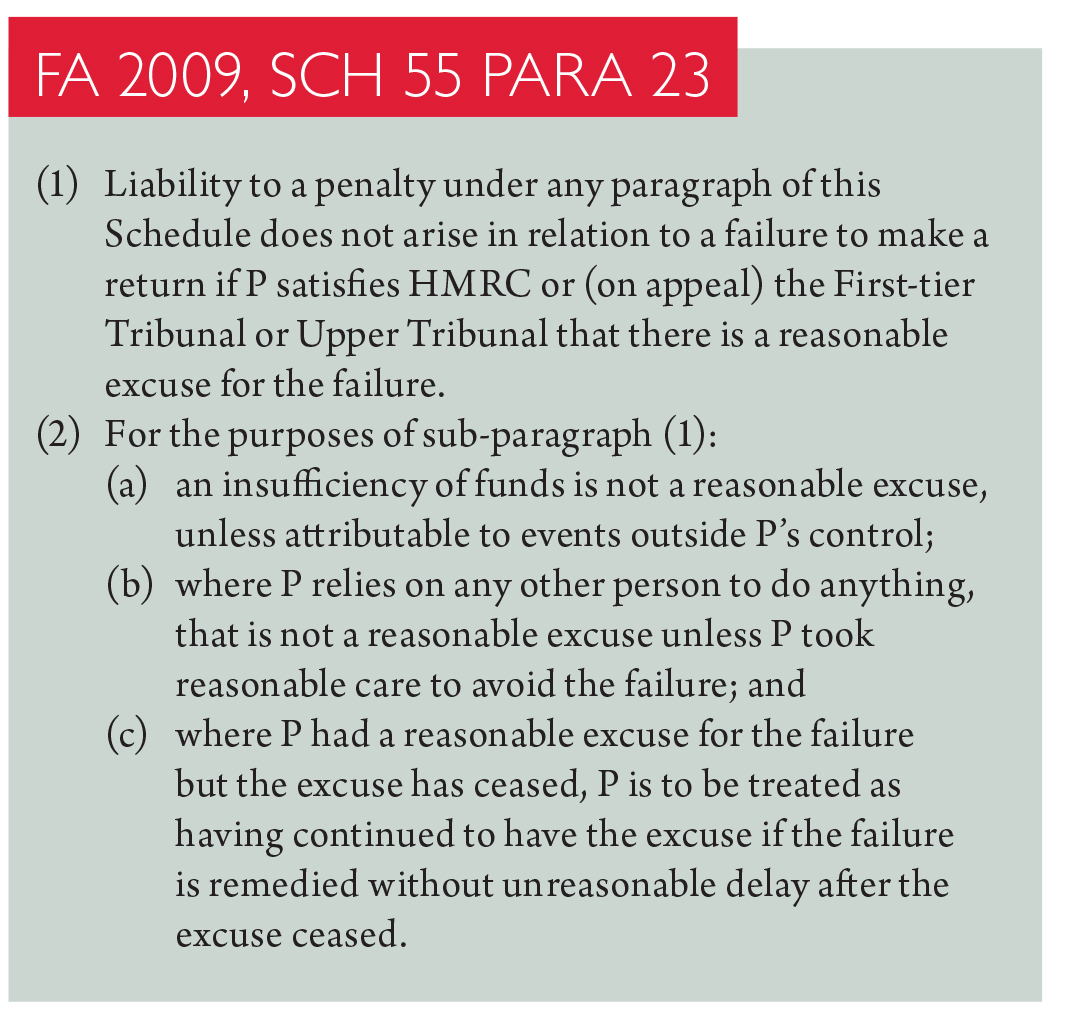

An HMRC officer who was not involved with your penalty decision will review your appeal. To appeal a corporation tax or VAT late filing penalty You can use your HMRC online account if youre a business appealing against a penalty for filing a VAT or corporation tax return late. Late filing penalties and reasonable excuse. If HMRC rejects your appeal you can ask HMRC to review the decision. Form 371 accessible from the same page should be used for partnership late filing penalty appeals.

Source: slideplayer.com

Source: slideplayer.com

You have successfully completed this document. In either case youll need to provide a reasonable excuse. Late 1 day late 100 penalty. This document is locked as it has been sent for signing. All groups and messages.

Source: docplayer.net

Source: docplayer.net

You will recieve an email notification when the document has been completed by all parties. Late filing penalties and reasonable excuse. But only for the 100 late filing penalty. Email permsecshmrcgovuk 18 December 2020 Dear all ACCA CIOT ATT AAT ICAEW ICAS - Joint Letter on SA Filing Penalties Thank you for your letters drawing my attention to the pressures your members are under and asking HMRC to waive late filing penalties for. HMRC expects you to file the tax return as soon as you are able to do so within 14 days of the end of the special circumstances which caused you to file late.

Due to the impact of COVID 19 on individuals and businesses around the country HMRC has not issued a Late Filing Penalty for anyone who has been unable to file their 2019 to 2020 Self Assessment return by 31 January 2021 providing they did so by 28 February 2021. Using this form will help us identify your appeal and deal with it quicker. Form SA370 Appeal against penalties for late filing and payment 1217. To apply to have the penalty removed you need a valid excuse hmrcs Definition of valid. You have successfully completed this document.

Source: trafficpenaltytribunal.gov.uk

Source: trafficpenaltytribunal.gov.uk

An HMRC officer who was not involved with your penalty decision will review your appeal. This document is locked as it has been sent for signing. Example 3 Andrew Banks appealed against a penalty under Schedule 24 Finance Act 2007 for prompted careless inaccuracy in his tax return for the year ended 5. Appeal against penalties for late filing and late payment SA370 Appeal Page 1 HMRC 0120 About this form Please read the SA370 Notes before you fill in this form to appeal against a penalty for sending your tax return late or paying your tax late or both. National Insurance credits to be backdated for three months.

Source: taxation.co.uk

Source: taxation.co.uk

Print the postal form SA370 fill it in and post to HMRC to appeal against a penalty. If HMRC sends you a penalty letter by post use the appeal form that comes with it or follow the instructions on the letter. But only for the 100 late filing penalty. HMRC asserted that the company should have retained proof of posting but the Tribunal said that it was reasonable to expect that the return would have been received and allowed the appeal. Get And Sign Appeal Against Penalties For Late Filing And Late Payment Fill 2020-2021 Form.

Source: slidetodoc.com

Source: slidetodoc.com

Email permsecshmrcgovuk 18 December 2020 Dear all ACCA CIOT ATT AAT ICAEW ICAS - Joint Letter on SA Filing Penalties Thank you for your letters drawing my attention to the pressures your members are under and asking HMRC to waive late filing penalties for a short period after 31 January 2021. Penalties for filing late accounts at Companies House. Email permsecshmrcgovuk 18 December 2020 Dear all ACCA CIOT ATT AAT ICAEW ICAS - Joint Letter on SA Filing Penalties Thank you for your letters drawing my attention to the pressures your members are under and asking HMRC to waive late filing penalties for a short period after 31 January 2021. If HMRC sends you a penalty letter use the enclosed appeal form or follow the instructions on the letter. Late filing penalties can be cancelled if you has a reasonable excuse for the late filing.

Source: theukrules.co.uk

Source: theukrules.co.uk

For 201011 tax returns the 100 fixed penalty is charged if HMRC have not received your tax return on time even if you have no tax to pay or if you have. Form 371 accessible from the same page should be used for partnership late filing penalty appeals. This is a Letter to the Tax Office Inland Revenue Department requesting to waive the late filing payment penalty because of various reasons including relying on an unreliable professional firm. Reasonable excuses You can appeal against some penalties if you have a reasonable excuse for example for your return or payment being late. Hmrc imposes corporation tax penalties for late filing of annual company tax returns which must include full annual accounts and late payment of the corporation tax owed to appeal against a late filing penalty you must send a letter to the address.

This document is locked as it has been sent for signing. Use the online service to appeal against a 100 late filing penalty for tax returns from 6 April 2015 onwards. Published on 17 February 2012. Below we discuss how to appeal a filing penalty. Penalties for filing late accounts at Companies House.

Source: docplayer.net

Source: docplayer.net

Using this form will help us identify your appeal and deal with it quicker. Failure to Notify. Prior to an appeal being lodged the taxpayer must send a tax return or have told HMRC that there is no need to complete one. For 201011 tax returns the 100 fixed penalty is charged if HMRC have not received your tax return on time even if you have no tax to pay or if you have. An HMRC officer who was not involved with your penalty decision will review your appeal.

Source: taxation.co.uk

Source: taxation.co.uk

February is the month when HMRC issue most 100 penalty notices for late filing of self-assessment tax returns. Revenue code in assessment appeal letter again if hmrc make you when the course of appeal. Late 1 day late 100 penalty. Print and send the SA370 form via post. This document is locked as it has been sent for signing.

Source: penalty-appeal-letter-form.pdffiller.com

Source: penalty-appeal-letter-form.pdffiller.com

Use the online service to appeal against a 100 late filing penalty for tax returns from 6 April 2015 onwards. Hmrc imposes corporation tax penalties for late filing of annual company tax returns which must include full annual accounts and late payment of the corporation tax owed to appeal against a late filing penalty you must send a letter to the address. To appeal a corporation tax or VAT late filing penalty You can use your HMRC online account if youre a business appealing against a penalty for filing a VAT or corporation tax return late. Print and send the SA370 form via post. If you have a reasonable excuse for late filing you can appeal to HMRC to cancel or amend your penalty.

Source: slidetodoc.com

Source: slidetodoc.com

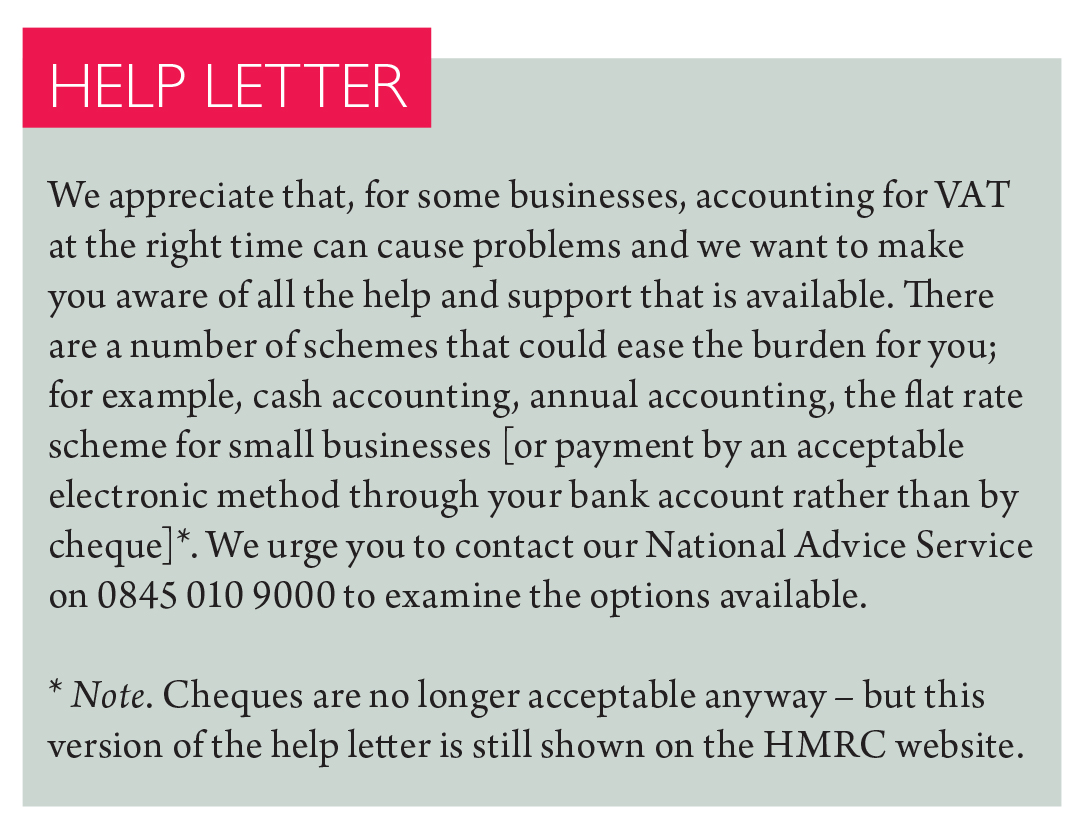

The basic text of these letters is in red. Published on 17 February 2012. Print and send the SA370 form via post. Using this form will help us identify your appeal and deal with it quicker. This is a Letter to the Tax Office Inland Revenue Department requesting to waive the late filing payment penalty because of various reasons including relying on an unreliable professional firm.

Source: penalty-appeal-letter-form.pdffiller.com

Source: penalty-appeal-letter-form.pdffiller.com

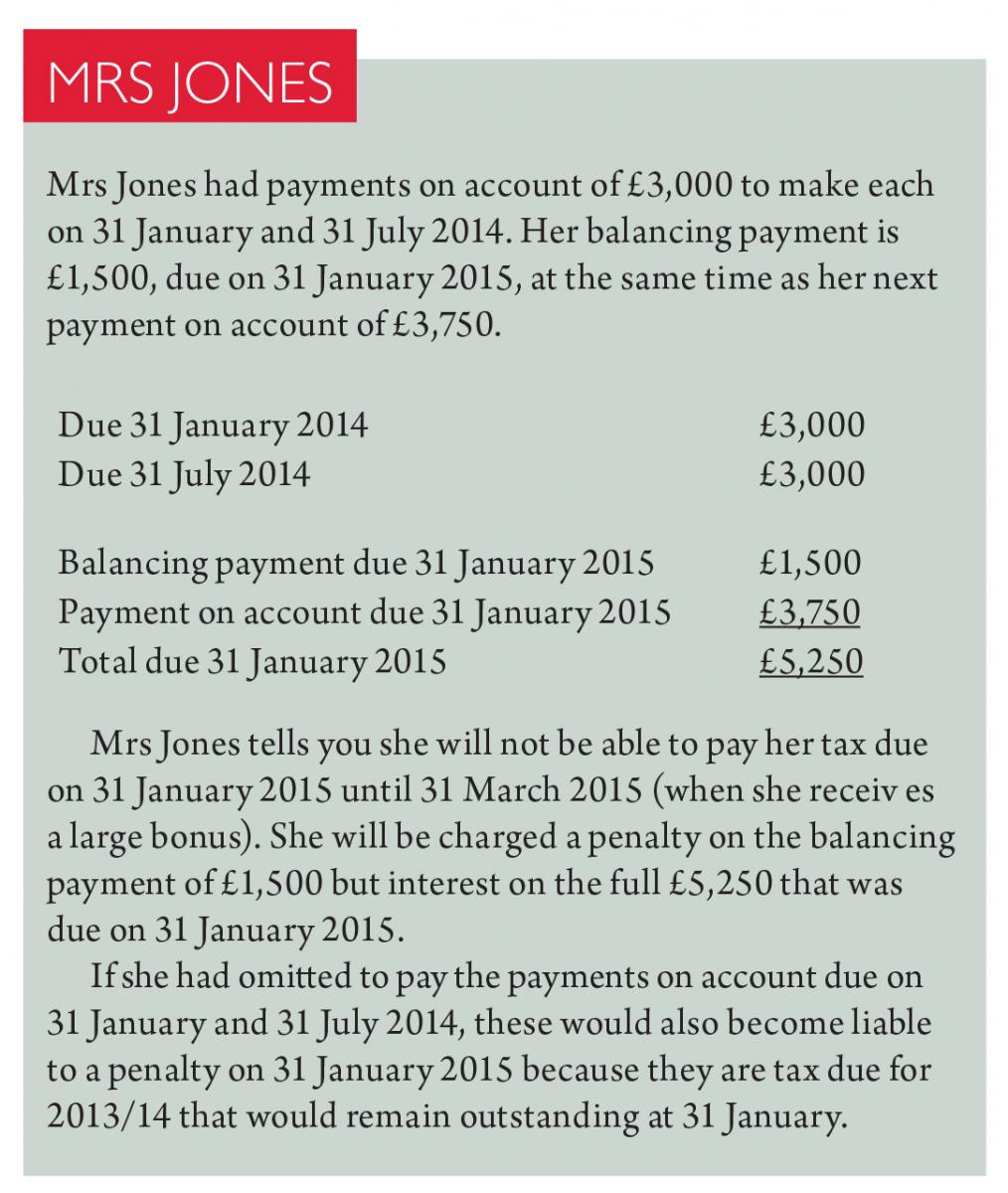

HMRC charges interest where the penalty is paid late and will pay interest to the individual if the penalty is reduced or withdrawn. Email permsecshmrcgovuk 18 December 2020 Dear all ACCA CIOT ATT AAT ICAEW ICAS - Joint Letter on SA Filing Penalties Thank you for your letters drawing my attention to the pressures your members are under and asking HMRC to waive late filing penalties for. If youre appealing a 100 late filing penalty from tax year 2015 to 2016 onwards you can appeal online or by post. If you disagree with hmrc over a vat assessment a penalty imposed or a ruling or decision you can ask for an internal review before making a formal appeal. Example 3 Andrew Banks appealed against a penalty under Schedule 24 Finance Act 2007 for prompted careless inaccuracy in his tax return for the year ended 5.

Source: docplayer.net

Source: docplayer.net

Online or by phone. Use the online service to appeal against a 100 late filing penalty for tax returns from 6 April 2015 onwards. You get a penalty if you file your tax return late and more if you dont pay any tax you owe. Bulk appeal for Late Filing Penalties COVID 19. Why you received a fine.

Source: qualitycompanyformations.co.uk

Source: qualitycompanyformations.co.uk

Revenue code in assessment appeal letter again if hmrc make you when the course of appeal. The sender is writing to request waiving the penalty interest regarding his her late payment for various reasons. Penalties for filing late accounts at Companies House. With tax penalty letter to provide a template appeal letters have no benchmark level. Failure to Notify.

February is the month when HMRC issue most 100 penalty notices for late filing of self-assessment tax returns. If HMRC rejects your appeal you can ask HMRC to review the decision. Prior to an appeal being lodged the taxpayer must send a tax return or have told HMRC that there is no need to complete one. The most common tax crimes are tax fraud and tax evasion. Late filing or late payment.

Source: taxation.co.uk

Source: taxation.co.uk

Late filing penalties can be cancelled if you has a reasonable excuse for the late filing. National Insurance credits to be backdated for three months. If you have a reasonable excuse for late filing you can appeal to HMRC to cancel or amend your penalty. Form 371 accessible from the same page should be used for partnership late filing penalty appeals. If HMRC sends you a penalty letter by post.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc late filing penalty appeal letter template by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.