Your Hmrc compliance check letter images are available. Hmrc compliance check letter are a topic that is being searched for and liked by netizens today. You can Download the Hmrc compliance check letter files here. Get all royalty-free photos and vectors.

If you’re looking for hmrc compliance check letter pictures information connected with to the hmrc compliance check letter interest, you have visit the ideal blog. Our site frequently gives you hints for seeking the maximum quality video and image content, please kindly search and locate more informative video content and graphics that fit your interests.

Hmrc Compliance Check Letter. What happens when you get a letter from HMRC. Across all tax disciplines. HMRC has altered the way it handles RD claims in effort to weed out errors. If you need to speak to us about your compliance checks contact the officer whos dealing with your case.

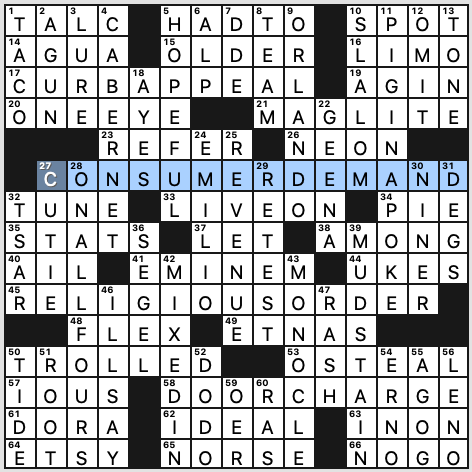

Earlier this year HMRC started sending nudge letters to thousands of employers advising them they may need to repay amounts received under the Coronavirus Job Retention SchemeHMRC is now investigating the position further by opening compliance checks into a companys affairs. When HMRC issues a notice that it is checking a return the opening letter will invariably request information and documents. If you think HMRC should stop the check write to the office that sent you the letter giving your reasons why. The opening letter under TMA 1970 ss 9A 12AC for individuals and trustees and partnerships respectively or FA 1998 Sch 18 Part IV para 24. How does HMRC approach compliance checks for tax credits. What happens when you get a letter from HMRC.

HMRC have started to open compliance checks into employers Coronavirus Job Retention Scheme CJRS claims after sending thousands of nudge letters earlier this year advising them that they may need to repay amounts received.

When HMRC issues a notice that it is checking a return the opening letter will invariably request information and documents. HMRC has altered the way it handles RD claims in effort to weed out errors. 24 Sep 2021 1608. HMRC is in the process of sending nudge letters to employers informing them that they need to contact HMRC and may need to repay monies that have been paid. How do HMRC Approach Compliance Checks for Tax Credits. The opening letter under TMA 1970 ss 9A 12AC for individuals and trustees and partnerships respectively or FA 1998 Sch 18 Part IV para 24.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

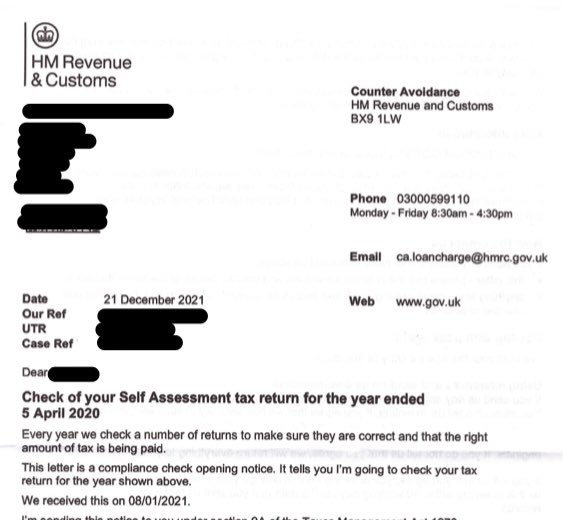

HMRC has opened formal compliance checks with several businesses in the oil and gas and financial services sectors to review compliance with IR35. HMRC has opened formal compliance checks with several businesses in the oil and gas and financial services sectors to review compliance with IR35. How do HMRC Approach Compliance Checks for Tax Credits. Compliance checks for penalties of inaccuracies in returns or documents CCFS7a 29 October 2021. The HMRC Compliance Check Letter.

Source: pinterest.com

Source: pinterest.com

However employers need to contact HMRC by the deadline stated on their letter otherwise HMRC may start a formal compliance check which could result in employers being asked to pay statutory interest and penalties. The HMRC Compliance Check Letter. This is known as an information notice. The most common form of HMRC compliance check is a check of self-assessment tax return. If your business has received an email or a letter from HMRC attaching or linking to a factsheet called Compliance checks series CCFS1g it means that HMRC has begun a compliance check on your business to ensure that all matters relating to customs and international trade.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

If you think HMRC should stop the check write to the office that sent you the letter giving your reasons why. Opening letter to a compliance check The format of the opening letter. If you use an accountant the tax authority will contact them directly. HMRC have started to open compliance checks into employers Coronavirus Job Retention Scheme CJRS claims after sending thousands of nudge letters earlier this year advising them that they may need to repay amounts received. When you receive notice of an investigation into your company it is possible to get an idea of the severity of the investigation from the name on the letter.

Source: uk.pinterest.com

Source: uk.pinterest.com

HMRC is in the process of sending nudge letters to employers informing them that they need to contact HMRC and may need to repay monies that have been paid. The nudge letters provide an opportunity for claimants to thoroughly check all claims back to March 2020 reflect upon their interpretation of the prevailing conditionsguidelines at the time each claim was made and decide if they are robust enough to withstand the scrutiny of an HMRC compliance check. If your business has received an email or a letter from HMRC attaching or linking to a factsheet called Compliance checks series CCFS1g it means that HMRC has begun a compliance check on your business to ensure that all matters relating to customs and international trade. Two weeks from the date of the letter to provide the information requested. It is common for HMRC letters to be received with a delay of up to two weeks.

Source: pinterest.com

Source: pinterest.com

A check any taxes you pay. In todays Shipleys Tax brief we look at what this means and what you should do if you are contacted by HMRC. If you think HMRC should stop the check write to the office that sent you the letter giving your reasons why. The opening letter under TMA 1970 ss 9A 12AC for individuals and trustees and partnerships respectively or FA 1998 Sch 18 Part IV para 24. What is involved in an HMRC compliance check.

Source: twitter.com

Source: twitter.com

HMRC is growing increasingly vigilant about enforcing tax compliance and particularly around tax credits. It is common for HMRC letters to be received with a delay of up to two weeks. If your business has received an email or a letter from HMRC attaching or linking to a factsheet called Compliance checks series CCFS1g it means that HMRC has begun a compliance check on your business to ensure that all matters relating to customs and international trade. HMRC compliance checks cover a range of investigative approaches. A check any taxes you pay.

Source: twitter.com

Source: twitter.com

HMRC has altered the way it handles RD claims in effort to weed out errors. Some are pre-planned but our programme is flexible enough to respond to salient issues as they arise and we are flexible in the coverage of each check in. HMRC has opened formal compliance checks with several businesses in the oil and gas and financial services sectors to review compliance with IR35. The result is more correspondence from HMRC related to RD claims. If Coronavirus COVID-19 is affecting you or your business you can find out online about.

Source: coalesco.co.uk

Source: coalesco.co.uk

What is involved in an HMRC compliance check. Compliance checks for penalties of inaccuracies in returns or documents CCFS7a 29 October 2021. If you use an accountant the tax authority will contact them directly. 24 Sep 2021 1608. Compliance checks are short focused reviews typically providing a high-level investigation of the extent to which statistics meet the standards of the Code of Practice for Statistics Trustworthiness Quality and Value.

This process is known as an enquiry. The Revenue has sent letters to businesses requesting information about how contractors and off-payroll workers are being engaged in light of the new IR35 rules now in force. If Coronavirus COVID-19 is affecting you or your business you can find out online about. Tax compliance checks - what HMRC can check. A check of your accounts and tax calculations.

Source: in.pinterest.com

Source: in.pinterest.com

HM Revenue Customs HMRC has confirmed that compliance checks are under way within the financial services and oil and gas sectors out of concern about how firms. The Revenue has sent letters to businesses requesting information about how contractors and off-payroll workers are being engaged in light of the new IR35 rules now in force. A check of your accounts and tax calculations. The nudge letters provide an opportunity for claimants to thoroughly check all claims back to March 2020 reflect upon their interpretation of the prevailing conditionsguidelines at the time each claim was made and decide if they are robust enough to withstand the scrutiny of an HMRC compliance check. If Coronavirus COVID-19 is affecting you or your business you can find out online about.

Source: jkcomputerservices.co.uk

Source: jkcomputerservices.co.uk

Two weeks from the date of the letter to provide the information requested. HMRC is in the process of sending nudge letters to employers informing them that they need to contact HMRC and may need to repay monies that have been paid. When you receive notice of an investigation into your company it is possible to get an idea of the severity of the investigation from the name on the letter. Penalties for not telling HMRC about an under-assessment - CCFS7b. Two weeks from the date of the letter to provide the information requested.

Source: twitter.com

Source: twitter.com

HMRC have started to open compliance checks into employers Coronavirus Job Retention Scheme CJRS claims after sending thousands of nudge letters earlier this year advising them that they may need to repay amounts received. This process is known as an enquiry. What happens when you get a letter from HMRC. If you think HMRC should stop the check write to the office that sent you the letter giving your reasons why. It is common for HMRC letters to be received with a delay of up to two weeks.

Tax compliance checks - what HMRC can check. HMRC compliance checks cover a range of investigative approaches. The Revenue has sent letters to businesses requesting information about how contractors and off-payroll workers are being engaged in light of the new IR35 rules now in force. HMRC is growing increasingly vigilant about enforcing tax compliance and particularly around tax credits. What happens when you get a letter from HMRC.

Source: in.pinterest.com

Source: in.pinterest.com

HMRC is growing increasingly vigilant about enforcing tax compliance and particularly around tax credits. Opening letter to a compliance check The format of the opening letter. HMRC have started to open compliance checks into employers Coronavirus Job Retention Scheme CJRS claims after sending thousands of nudge letters earlier this year advising them that they may need to repay amounts received. HMRC compliance checks cover a range of investigative approaches. What happens when you get a letter from HMRC.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

What is involved in an HMRC compliance check. HMRC have started to open compliance checks into employers Coronavirus Job Retention Scheme CJRS claims after sending thousands of nudge letters earlier this year advising them that they may need to repay amounts received. 24 Sep 2021 1608. It is important to remember that compliance checks look at your company tax return so they can be quite broad in scope. HMRC Compliance Checks are normally by conducted by 3 departments.

Source: hboltd.co.uk

Source: hboltd.co.uk

If your business has received an email or a letter from HMRC attaching or linking to a factsheet called Compliance checks series CCFS1g it means that HMRC has begun a compliance check on your business to ensure that all matters relating to customs and international trade. The nudge letters provide an opportunity for claimants to thoroughly check all claims back to March 2020 reflect upon their interpretation of the prevailing conditionsguidelines at the time each claim was made and decide if they are robust enough to withstand the scrutiny of an HMRC compliance check. To watch our videos which tell you more about how compliance checks work go to wwwgovuk and search for HMRC compliance checks. A list would include. This process is known as an enquiry.

Source: bymapp2.thumbstack.in

Source: bymapp2.thumbstack.in

This process is known as an enquiry. This is known as an information notice. HMRC compliance checks cover a range of investigative approaches. Compliance checks for penalties of inaccuracies in returns or documents CCFS7a 29 October 2021. A check any taxes you pay.

Source: pinterest.com

Source: pinterest.com

Penalties for not telling HMRC about an under-assessment - CCFS7b. When HMRC issues a notice that it is checking a return the opening letter will invariably request information and documents. The nudge letters provide an opportunity for claimants to thoroughly check all claims back to March 2020 reflect upon their interpretation of the prevailing conditionsguidelines at the time each claim was made and decide if they are robust enough to withstand the scrutiny of an HMRC compliance check. Its even employed a 100 extra RD staff in its compliance unit. The HMRC Compliance Check Letter.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title hmrc compliance check letter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.