Your Credit dispute letter to collection agency images are available. Credit dispute letter to collection agency are a topic that is being searched for and liked by netizens now. You can Find and Download the Credit dispute letter to collection agency files here. Find and Download all royalty-free photos.

If you’re searching for credit dispute letter to collection agency images information linked to the credit dispute letter to collection agency interest, you have visit the right blog. Our website frequently provides you with suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video articles and images that match your interests.

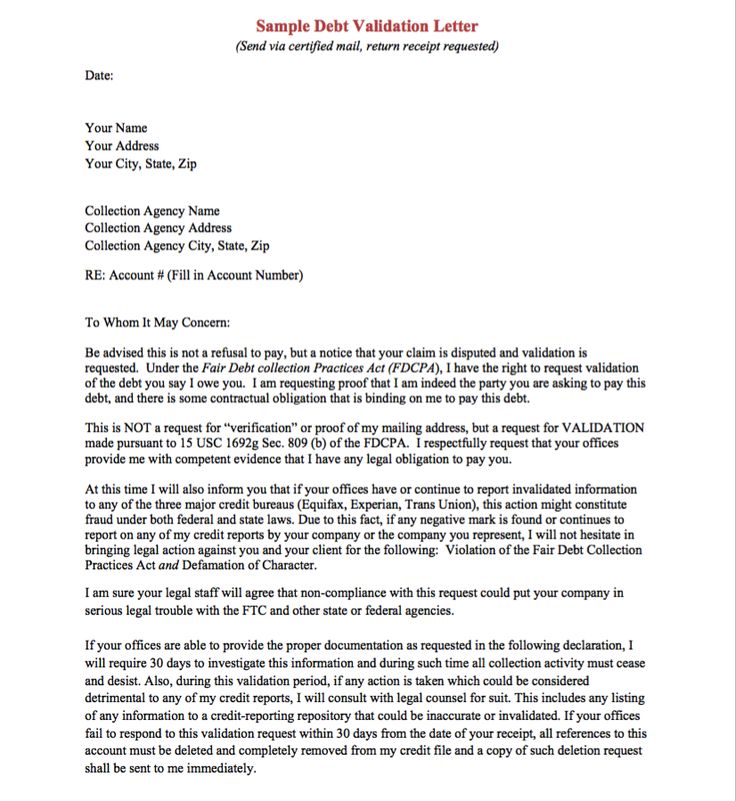

Credit Dispute Letter To Collection Agency. Our software automatically generates inquiry and collection dispute letters for you. In the letter reference the date of the initial contact and the method for example a phone call received from your agency on April 25. SAMPLE LETTER TO COLLECTION AGENCY DISPUTING DEBT The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they. Sample letters to dispute information on a credit report.

Credit Dispute Letters 2 638 Credit Repair Letters Credit Dispute Credit Repair Business From pinterest.com

Credit Dispute Letters 2 638 Credit Repair Letters Credit Dispute Credit Repair Business From pinterest.com

Collectors Name Collectors Address City State Zip Code. Your Name Your Address City State Zip Code. If you want to dispute information on a credit report you may need to send a dispute letter to both the institution that provided the. Our software automatically generates inquiry and collection dispute letters for you. Ad Answer Simple Questions to Make A Credit Card Dispute On Any Device In Minutes. Writing a letter to the credit bureaus or a debt collection agency can be daunting.

Ad Answer Simple Questions to Make A Credit Card Dispute On Any Device In Minutes.

Ad Answer Simple Questions to Make A Credit Card Dispute On Any Device In Minutes. If the consumer reporting agencies prove that your. Create Legal Documents Using Our Clear Step-By-Step Process. A pay for delete letter is an offer to a creditor or debt collector to remove a negative credit report entry in exchange for payment. The bad news is that disputing credit with a debt collection agency isnt an easy road. Weve gathered all of our sample letter templates as well as writing tips to help you personalize your letter and.

Source: pinterest.com

Source: pinterest.com

How To Write a Debt Validation Letter. Dispute Letter to Credit Bureaus The Dispute is an inescapable part of life. Your letter should identify each item you dispute state the facts explain why. A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount. Thus if you have already reported this debt to any credit-reporting agency CRA or Credit Bureau CB then you must immediately inform them of my dispute with this.

Source: pinterest.com

Source: pinterest.com

In the letter reference the date of the initial contact and the method for example a phone call received from your agency on April 25. It shows your credit and payment. If the consumer reporting agencies prove that your. The bad news is that disputing credit with a debt collection agency isnt an easy road. A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount.

Source: pinterest.com

Source: pinterest.com

Pursuant to the Fair Debt Collection Practices Act Section 809b Validating. Weve gathered all of our sample letter templates as well as writing tips to help you personalize your letter and. In the letter reference the date of the initial contact and the method for example a phone call received from your agency on April 25. Pursuant to the Fair Debt Collection Practices Act Section 809b Validating. A creditor writes the dispute letter to credit bureaus as to mention the mistakes of the payment.

Source: pinterest.com

Source: pinterest.com

Ad Credit Report Dispute More Fillable Forms Register and Subscribe Now. The investigation usually runs for 30 days. Ad Answer Simple Questions to Make A Credit Card Dispute On Any Device In Minutes. The Disputed Debts clause of the Fair Debt Collection Practices Act gives you a 30-day window within which to dispute the debt in writing and request that the collector. A creditor writes the dispute letter to credit bureaus as to mention the mistakes of the payment.

Source: pinterest.com

Source: pinterest.com

Writing a letter to the credit bureaus or a debt collection agency can be daunting. Thus if you have already reported this debt to any credit-reporting agency CRA or Credit Bureau CB then you must immediately inform them of my dispute with this. Our software automatically generates inquiry and collection dispute letters for you. In the letter reference the date of the initial contact and the method for example a phone call received from your agency on April 25. Your letter should identify each item you dispute state the facts explain why.

Source: pinterest.com

Source: pinterest.com

A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount. Sample letters to dispute information on a credit report. Dispute Letter to Credit Bureaus The Dispute is an inescapable part of life. Our software automatically generates inquiry and collection dispute letters for you. Thus if you have already reported this debt to any credit-reporting agency CRA or Credit Bureau CB then you must immediately inform them of my dispute with this.

Source: pinterest.com

Source: pinterest.com

Sample letters to dispute information on a credit report. The Disputed Debts clause of the Fair Debt Collection Practices Act gives you a 30-day window within which to dispute the debt in writing and request that the collector. It shows your credit and payment. Credit bureaus will investigate to determine the validity of your collection dispute. If you want to dispute information on a credit report you may need to send a dispute letter to both the institution that provided the.

Source: pinterest.com

Source: pinterest.com

Collectors Name Collectors Address City State Zip Code. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Ad Dispute items on your credit report like a professional using DisputeBee. Sample Dispute Letter To A Collection Agency. The investigation usually runs for 30 days.

Source: pinterest.com

Source: pinterest.com

The only way you can hold them accountable is by building. Ad Answer Simple Questions to Make A Credit Card Dispute On Any Device In Minutes. Collectors Name Collectors Address City State Zip Code. Writing a letter to the credit bureaus or a debt collection agency can be daunting. If you want to dispute information on a credit report you may need to send a dispute letter to both the institution that provided the.

Source: pinterest.com

Source: pinterest.com

Sample Dispute Letter To A Collection Agency. Sample Dispute Letter To A Collection Agency. If the consumer reporting agencies prove that your. Dispute Letter to Credit Bureaus The Dispute is an inescapable part of life. The bad news is that disputing credit with a debt collection agency isnt an easy road.

Source: pinterest.com

Source: pinterest.com

The Disputed Debts clause of the Fair Debt Collection Practices Act gives you a 30-day window within which to dispute the debt in writing and request that the collector. The only way you can hold them accountable is by building. Pursuant to the Fair Debt Collection Practices Act Section 809b Validating. One of the most important powers you have as a consumer of credit is the power to utilize a credit dispute letter to dispute any inaccuracies on your credit report. Sample letters to dispute information on a credit report.

Source: pinterest.com

Source: pinterest.com

One of the most important powers you have as a consumer of credit is the power to utilize a credit dispute letter to dispute any inaccuracies on your credit report. The Disputed Debts clause of the Fair Debt Collection Practices Act gives you a 30-day window within which to dispute the debt in writing and request that the collector. Pursuant to the Fair Debt Collection Practices Act Section 809b Validating. How To Write a Debt Validation Letter. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus.

Source: pinterest.com

Source: pinterest.com

SAMPLE LETTER TO COLLECTION AGENCY DISPUTING DEBT The following page is a sample of a letter that you can send to a collection agency if you think you do not owe the money they. Use this sample letter to dispute incorrect or inaccurate information that a business supplied to credit bureaus. Go Paperless Fill Sign Documents Electronically. Ad Dispute items on your credit report like a professional using DisputeBee. Sample letters to dispute information on a credit report.

Source: pinterest.com

Source: pinterest.com

In the letter reference the date of the initial contact and the method for example a phone call received from your agency on April 25. If the consumer reporting agencies prove that your. If you want to dispute information on a credit report you may need to send a dispute letter to both the institution that provided the. Ad Credit Report Dispute More Fillable Forms Register and Subscribe Now. Already reported this debt to any credit-reporting agency CRA or Credit Bureau CB then you must.

Source: pinterest.com

Source: pinterest.com

Sample Dispute Letter To A Collection Agency. Your letter should identify each item you dispute state the facts explain why. A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount. What You Need to Know About Writing a Credit Dispute Letter to Collection Agency Your credit report is a very important aspect of your financial health. The bad news is that disputing credit with a debt collection agency isnt an easy road.

Source: pinterest.com

Source: pinterest.com

Our software automatically generates inquiry and collection dispute letters for you. A debt dispute letter demands that the collection agency demonstrate that you do indeed owe the debt and can provide detailed information and documents to prove the amount. How To Write a Debt Validation Letter. Your Name Your Address City State Zip Code. One of the most important powers you have as a consumer of credit is the power to utilize a credit dispute letter to dispute any inaccuracies on your credit report.

Source: pinterest.com

Source: pinterest.com

Sample Dispute Letter To A Collection Agency. Pursuant to the Fair Debt Collection Practices Act Section 809b Validating. It shows your credit and payment. Sample Pay for Delete Letter. Your letter should identify each item you dispute state the facts explain why.

Source: pinterest.com

Source: pinterest.com

Collectors Name Collectors Address City State Zip Code. What You Need to Know About Writing a Credit Dispute Letter to Collection Agency Your credit report is a very important aspect of your financial health. If the consumer reporting agencies prove that your. The investigation usually runs for 30 days. Already reported this debt to any credit-reporting agency CRA or Credit Bureau CB then you must.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title credit dispute letter to collection agency by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.